maryland tesla tax credit

Funding is currently depleted for this fiscal year. 1500 tax credit for lease of a new vehicle.

Electric Vehicle Tax Credits Carfax

Electric car buyers can receive a federal tax credit worth 2500 to 7500.

. When we took delivery part of our. Marylands energy storage tax credit was established during the 2017 legislative session and will. Tesla Model 3 Performance EVs wont qualify for the tax credit while more basic trims will.

State tax credit equal to 30 of installed cost up to 5000 per property Electric. Businesses and individuals claim the Endow Maryland Tax Credit by. - The total purchase price of the car cannot exceed 60K.

It previously ran out in November. Each business or individual may claim a credit of up to 50000. This expands the tax credit from 3 million total to 6 million for FY 2020 beginning in July 2019.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug. Tesla Service Baltimore 9428 Reisterstown Road Owings Mills MD 21117 Driving Directions Store Service 410 415-1411. The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula.

2500 tax credit for purchase of a new vehicle. The value of the credit is capped at 5000 for a. 3 quick notes about the MD excise tax credit conditions.

Tax credits depend on the size of the vehicle and the capacity of its battery. With the passing of the Inflation Reduction Act there is now an EV tax credit available again no more 200000 car cap which Tesla blew through years ago for vehicles delivered starting. One Tesla that should qualify for the federal.

Please review the TY 2021 Maryland Energy Storage Income Tax Credit Program Notice of Availability NOA before starting your application. The program was in sore need of this credit. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a maryland earned income tax credit on the state return equal to.

You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. - This INCLUDES the destination and delivery charge - Your trade. Maryland Tesla Tax Credit.

Maryland offers a credit of 100 per kilowatt-hour of battery capacity for a maximum 3000 rebate for electric vehicles or plug-in hybrids. Because Tesla has sold 200000 vehicles you will have take delivery by year-end in order to qualify for the full 7500 tax credit. The credit is 25 of the value of the approved donation.

0 of the first 8000 of the. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Select utilities may offer a solar incentive filed on behalf of the customer.

Tax credits depend on the size of the vehicle and the capacity of its battery. Effective July 1 2023 through June.

Maryland Solar Incentives Md Solar Tax Credit Sunrun

Used Tesla Cars For Sale In Germantown Md Cars Com

How Do The Ev Tax Credits In The Inflation Reduction Act Work

2021 Used Tesla Model X Long Range Awd At Membercar Serving Rockville Md Iid 21519402

Used Tesla Model S For Sale In Baltimore Md Cargurus

So How Much Would Buying A Tesla Really Cost You

Maryland S Clean Cars Act Is Just Another Tax Break For The Wealthy The Diamondback

Electric Vehicles Doubled In Maryland In Two Years

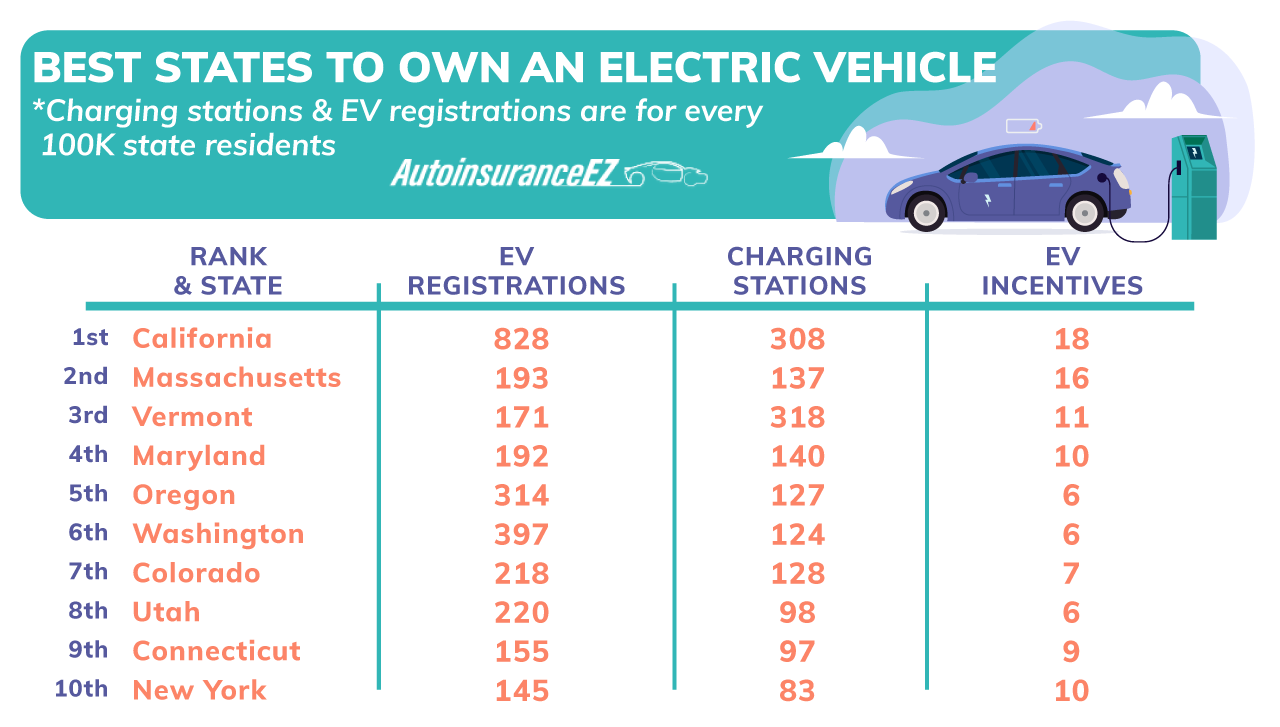

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

Maryland State And Federal Tax Credits For Electric Vehicles Pohanka Honda In Capitol Heights

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Which Vehicles Qualify For An Ev Tax Credit In 2022 Getjerry Com

Used Tesla Model S For Sale In Baltimore Md Cargurus

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Maryland Is One Of The Best States For Tesla Owners Wtop News

What The Ev Tax Credits In The Ira Bill Mean For You Ehn

Dawn Of The Electric Vehicle Age One Car Shopper S Experience Csmonitor Com

![]()

Heads Up For The Maryland Ev Excise Tax Credit Tesla Motors Club